Landed Cost Calculator

Total landed cost calculation refers to the calculation of the total cost, including all duties, taxes and fees required from the time of export to the time the exported goods reach the overseas customer. Total landed cost calculation is essential for accurate cost control and profitability.

- Optimize pricing: By taking all relevant costs into account, you can set the right selling price to ensure profits.

- Enhanced cost control: Understanding cost factors such as customs duties, other import taxes, and logistics costs allows for efficient cost management.

- Risk avoidance: Prevents profit loss due to underestimation and loss of sales opportunities due to overestimation, improving business stability.

- Increase customer satisfaction: Upfront quotes build trust and ensure transparency in the transaction.

For details, please refer to the Customs & Trade Links Collection on our website.

This tool allows you to estimate additional tariffs (US reciprocal tariffs).

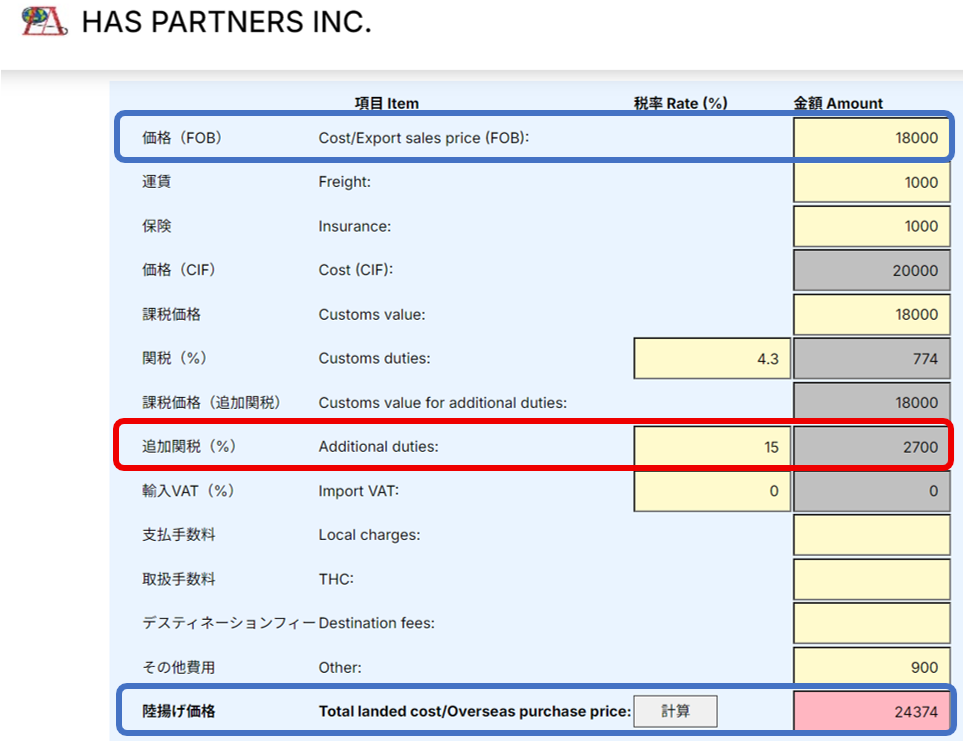

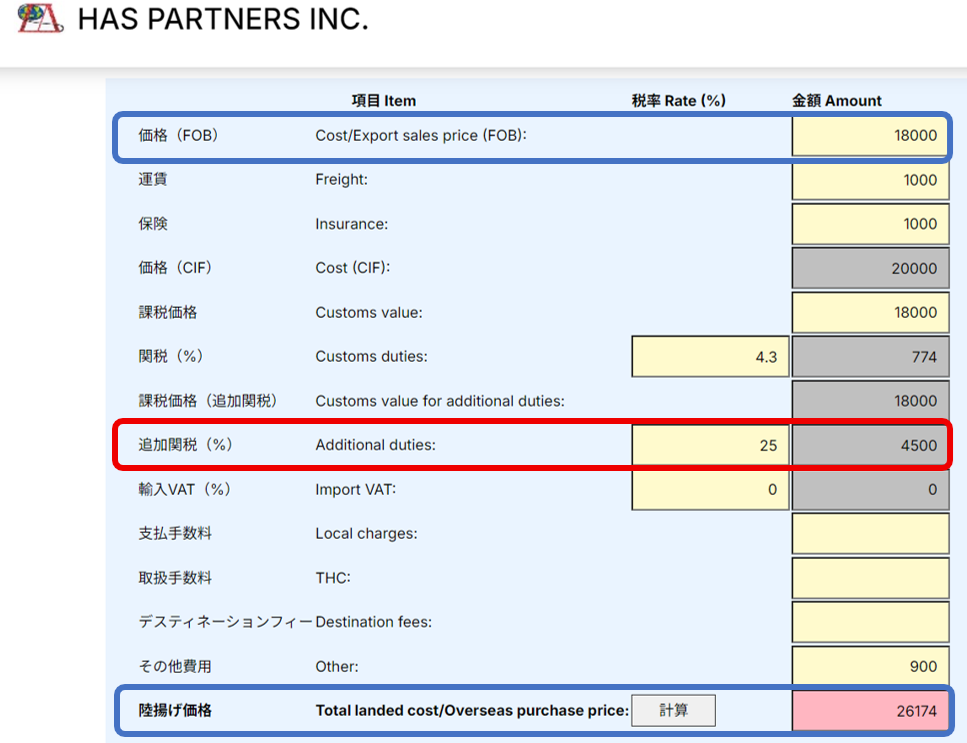

For example, calculate under the following conditions:

- Customs duty prices are based on FOB basis

- The normal tariff rate is 4.3%.

- The additional tariff rate (reciprocal tariff) will be either 15% or 25%.

- Import-related costs in the importing country (partner country) shall be 5% of the FOB price.

When calculated under these conditions, the landed cost will be USD 24,374 if the additional tariff rate is 15% and USD 26,174 if the additional tariff rate is 25%.

If you would like to discuss profit margin calculations for each product or develop a specific pricing strategy for your products, please feel free to contact us.(comm@has-partners.com)

Contact form